Digital Lending Market Set to Skyrocket to $795 Billion by 2029, Driven by AI and DeFi Innovations

Summary

Full Article

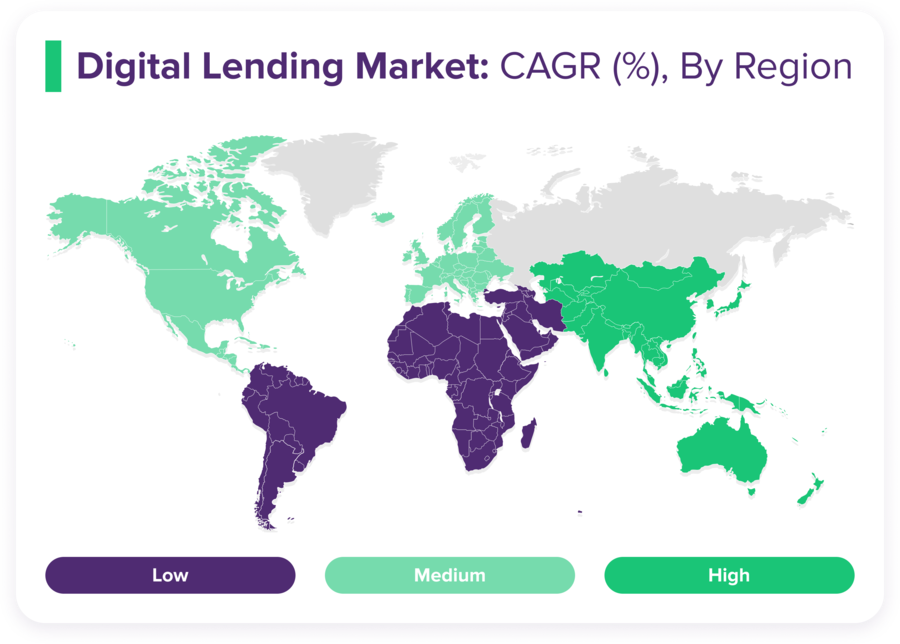

The digital lending sector is on the brink of unprecedented growth, with projections indicating a surge to USD 795.34 billion by 2029, according to a recent report by Singapore-based fintech company ROSHI. This growth, marked by an 11.90% compound annual growth rate (CAGR), is fueled by advancements in artificial intelligence (AI), peer-to-peer (P2P) lending, and decentralized finance (DeFi), reshaping the landscape of financial services worldwide.

AI's integration into lending models is revolutionizing credit risk assessment, offering a potential 10-15% improvement over traditional methods. This leap forward promises more precise lending decisions and broader credit access for both individuals and businesses. Meanwhile, P2P lending is carving out a significant niche, with expectations to exceed US$705.81 billion by 2030, thanks to its competitive rates and flexibility.

DeFi stands out as a particularly disruptive force, with its market value anticipated to grow at a 46.0% CAGR from 2023 to 2030. This growth highlights blockchain technology's potential to democratize financial services and enhance inclusivity. Additionally, open banking is gaining momentum, with 13% of digitally active consumers in key European markets utilizing these services by January 2024, paving the way for more tailored financial products.

Amir Nada, ROSHI Founder and CEO, remarked on the sector's explosive growth, noting the transformative potential of these trends. However, this rapid expansion brings to light the need for adaptive regulatory frameworks to safeguard consumers and ensure stability amidst innovation.

For traditional financial institutions, the message is clear: adapt or risk obsolescence. The shift towards digital lending underscores the necessity for embracing technological advancements and fostering fintech collaborations. Consumers, on the other hand, stand to gain from enhanced credit access and personalized offerings, though navigating this evolving landscape will require heightened financial literacy.

As the digital lending market marches towards its projected $795 billion valuation, its role in the future of finance is undeniable. The ROSHI report serves as a critical resource for industry stakeholders, offering insights into the opportunities and challenges that lie ahead in this dynamic sector.

This story is based on an article that was registered on the blockchain. The original source content used for this article is located at 24-7 Press Release

Article Control ID: 92137