Valens Semiconductor Ltd. Poised for Growth in Connectivity Solutions Market

Summary

Full Article

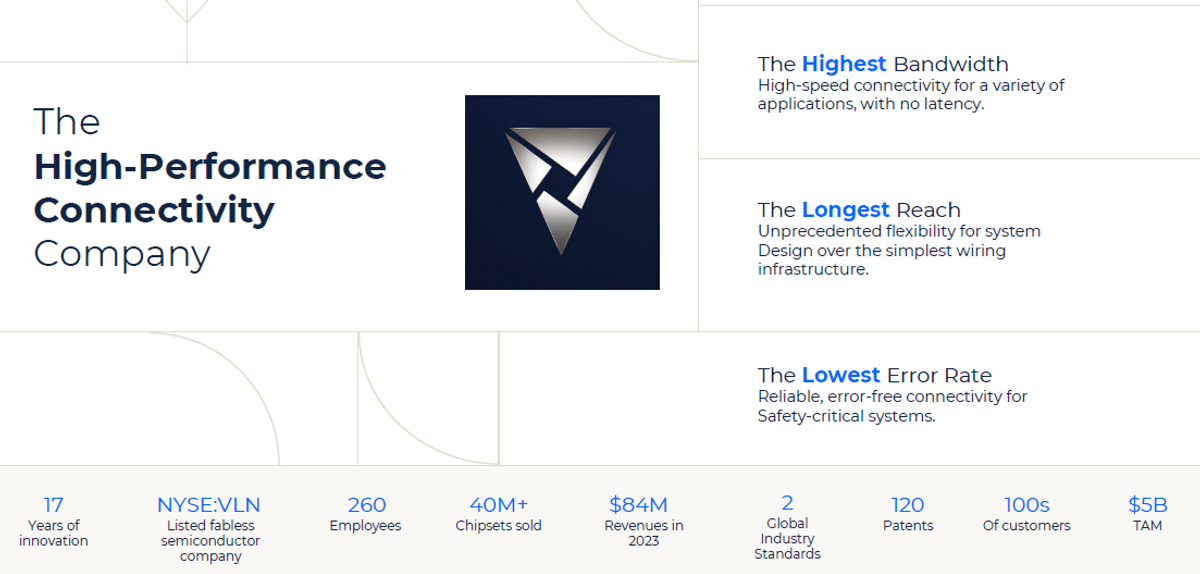

Valens Semiconductor Ltd. (NYSE:VLN) is carving out a significant niche in the connectivity solutions sector, with its technology poised to make a substantial impact across the automotive, professional audiovisual (Pro-AV), and industrial machine vision markets. With a foundation built on 17 years of experience and a portfolio boasting over 120 patents, the company's strategic partnerships, including a notable collaboration with Mercedes-Benz and design wins with leading European automotive OEMs, underscore its market potential.

The company operates within markets that collectively represent a total addressable market (TAM) of approximately $5.5 billion. The automotive segment, with a $4.5 billion TAM, presents the most immediate opportunity, followed by the Pro-AV and industrial machine vision subsegments at $350 million and $460 million, respectively. Valens' growth strategy is meticulously tailored to expand its footprint in these areas, with industrial machine vision expected to gain momentum in 2026 and 2027, and automotive market penetration anticipated in the following years.

Financially, Valens stands on solid ground, with $133.1 million in cash and equivalents and a notable improvement in its working capital position, evidenced by a reduction in inventory from $23.8 million at the end of fiscal year 2022 to $11.7 million in the third quarter of 2024. The company's revenue projections further highlight its growth trajectory, with expectations set between $57.2 million and $57.5 million for the full year 2024, and a more ambitious range of $71.0 million to $76.0 million for 2025, marking a year-over-year growth of approximately 25% to 33%.

Stonegate Capital Partners' valuation analysis paints a promising picture for Valens, with a potential share price range between $4.42 and $5.57, based on a discounted cash flow model. An alternative valuation approach, considering enterprise value to revenue, suggests a slightly higher range of $4.70 to $5.39. As a co-founder of the HDBaseT Alliance, which includes industry giants like Samsung, LG, and Sony among its over 200 members, Valens is well-positioned to maintain its leadership in the connectivity solutions space, driving innovation and growth in the years to come.

This story is based on an article that was registered on the blockchain. The original source content used for this article is located at Reportable

Article Control ID: 93401