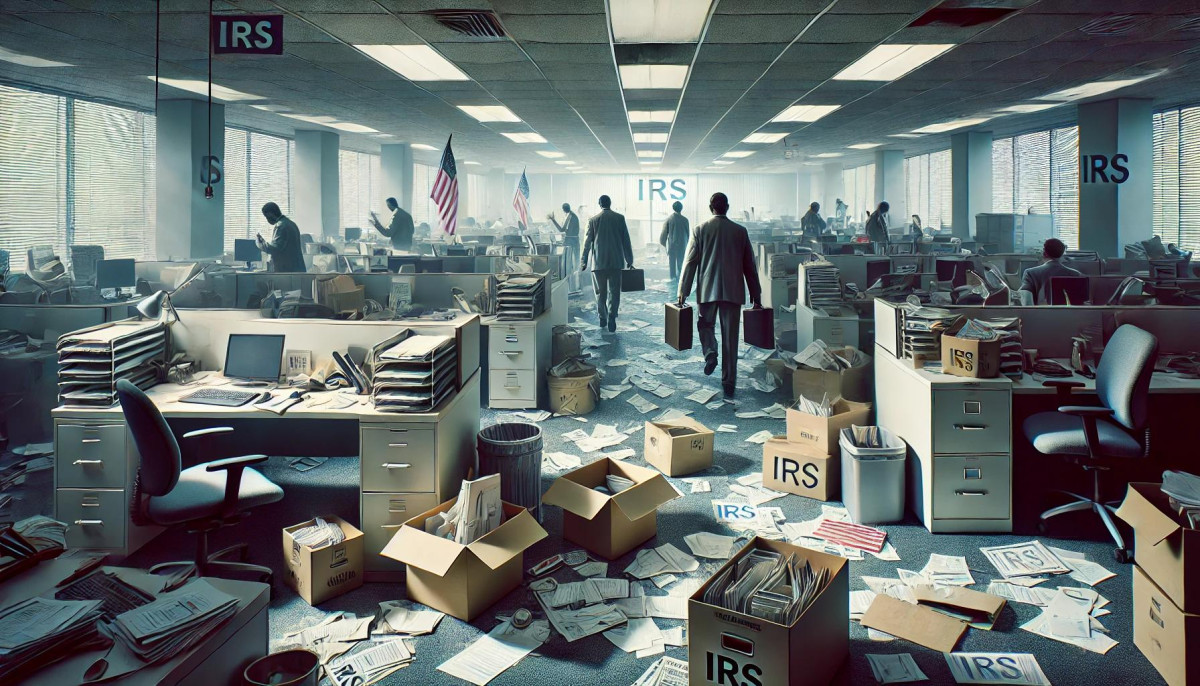

IRS Workforce Reduction Threatens to Disrupt Upcoming Tax Season

Summary

Full Article

The Internal Revenue Service (IRS) is navigating through a period of significant operational hurdles after a reduction in its workforce by 6,000 employees. This downsizing, a result of federal workforce cuts initiated during the previous administration, is poised to disrupt the upcoming tax season, affecting millions of taxpayers across the United States. The implications of these layoffs extend across various critical functions of the IRS, including the processing of tax returns, the distribution of refunds, and the provision of customer support services.

Taxpayers are likely to face extended wait times and delays in receiving their refunds, a situation that could impose financial hardships on families depending on these funds for essential expenses. The reduction in staff is also expected to worsen the already strained customer service capabilities of the IRS, leaving many taxpayers without timely assistance for their queries and concerns. Furthermore, the capacity of the IRS to conduct audits and ensure tax compliance is anticipated to be significantly hampered, leading to longer processing times for audit notifications and fewer resources for individuals dealing with complex tax issues.

The most affected areas include audit processing, compliance checks, and customer support, placing taxpayers with pending tax debts or those in need of specialized tax assistance in a particularly vulnerable position. Tax professionals are advising individuals to prepare for these challenges by keeping detailed financial records and consulting with tax experts to navigate the potential pitfalls of the upcoming tax season.

This situation sheds light on the broader implications of workforce reductions within government agencies, raising questions about the balance between efficiency and the ability to serve the public effectively. As the tax season progresses, the full impact of these operational changes will become clearer, possibly requiring taxpayers to adjust their strategies for fulfilling their tax obligations. The current scenario underscores the importance of proactive planning and the need for potential policy adjustments to mitigate the adverse effects on taxpayers and the tax administration system as a whole.

This story is based on an article that was registered on the blockchain. The original source content used for this article is located at Press Services

Article Control ID: 85888