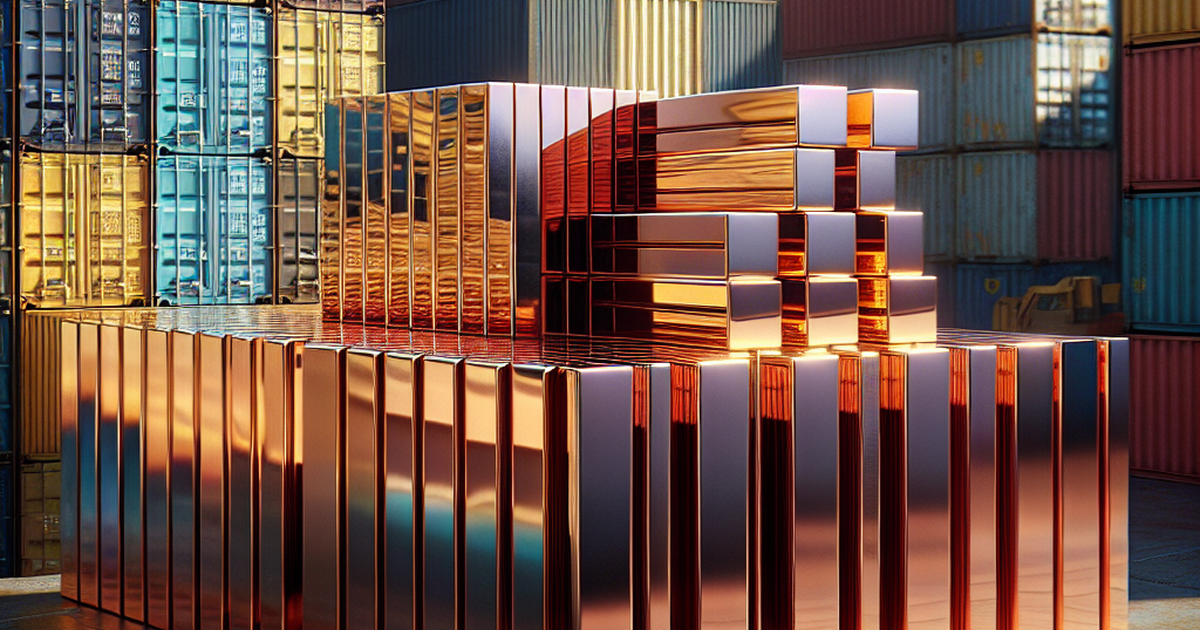

Global Copper Market Faces Strain as US Demand Surges, Highlighting Supply Disparities

Summary

Full Article

The global copper market is currently under significant pressure due to an unprecedented surge in demand from the United States, coupled with the looming possibility of import duties. This heightened demand has precipitated a sharp decline in copper inventories on the London Metal Exchange, reaching record lows. Such developments are indicative of the widening supply disparities across different regions, with the US absorbing a larger portion of global copper shipments, leaving other areas grappling with shortages.

This scenario poses considerable challenges for industries heavily dependent on copper, including construction, electronics, and renewable energy sectors. The tightening supply could not only drive up prices but also disrupt supply chains, affecting a wide range of products from consumer electronics to critical infrastructure projects. The ripple effects of these disruptions could be felt globally, underscoring the vulnerability of industries to fluctuations in commodity markets.

Investors are keeping a close eye on the evolving situation, with companies that have substantial copper reserves, such as Aston Bay Holdings Ltd., potentially becoming more valuable in this constrained market. The current market dynamics serve as a stark reminder of the intricate links within global trade networks and how policy shifts in one nation can have widespread consequences. As the US continues to dominate copper procurement, other regions may be compelled to seek alternative materials or sources, possibly altering the global commodities landscape in the long term.

The implications of these developments extend beyond immediate supply concerns, highlighting the need for strategic planning and diversification in industries reliant on copper. The situation also raises questions about the sustainability of current consumption patterns and the potential for innovation in materials science to mitigate future supply risks. As the global economy navigates these challenges, the copper market's fluctuations offer critical insights into the complexities of international trade and resource management.

This story is based on an article that was registered on the blockchain. The original source content used for this article is located at InvestorBrandNetwork (IBN)

Article Control ID: 84383